1. Introduction: The Evolution of Finance

Brief History of Traditional Finance

For centuries, the world of finance has been dominated by centralized institutions—banks, governments, and corporations. These entities acted as intermediaries, controlling everything from lending and borrowing to asset custody and wealth management. While traditional finance has enabled economic growth, it also comes with limitations: high fees, slow processes, limited access, and often a lack of transparency.

The Emergence of Blockchain and Cryptocurrencies

In 2009, Bitcoin was introduced as the first decentralized digital currency, setting the foundation for the development of blockchain technology. By eliminating the need for intermediaries, Bitcoin offered a peer-to-peer system for transferring value. As blockchain evolved, it became clear that this technology could disrupt more than just currency—it could decentralize the entire financial system.

What is Decentralized Finance (DeFi)?

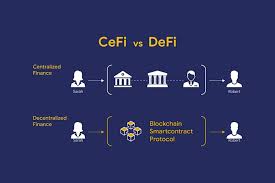

Decentralized Finance (DeFi) refers to a set of financial services and applications built on blockchain networks, primarily Ethereum. Unlike traditional finance, DeFi operates without intermediaries like banks or brokers. Instead, it uses smart contracts—self-executing contracts with the terms directly written into code. DeFi allows anyone with internet access to borrow, lend, trade, and invest digital assets in a transparent and trustless manner, reshaping the future of finance.

2. What Makes DeFi Different from Traditional Finance?

Centralization vs. Decentralization

In traditional finance, control is centralized in institutions that act as gatekeepers, deciding who can access financial services. DeFi, on the other hand, is decentralized. This means no single entity controls the system, and anyone can participate without needing permission. Transactions and financial services are governed by code and run autonomously on the blockchain, making the system open, global, and accessible.

Permissionless and Borderless: How DeFi Removes Barriers

DeFi protocols are permissionless—anyone with a crypto wallet can access DeFi services without needing approval from a bank or government. Additionally, DeFi is borderless. Traditional financial systems are often constrained by geographical and political boundaries, but DeFi operates on the blockchain, enabling global participation regardless of location.

Transparency and Security: The Role of Blockchain in DeFi

Blockchain’s transparent nature ensures that all transactions are visible to anyone, providing unparalleled accountability. Every transaction and contract is recorded on a public ledger, ensuring that nothing can be altered without consensus. The cryptographic nature of blockchain also enhances security, reducing the risks of fraud, manipulation, or unauthorized changes.

3. How DeFi Works: The Key Components

Smart Contracts: Automating Trust and Transactions

Smart contracts are the backbone of DeFi. These are self-executing contracts where the terms of the agreement are written into lines of code. Once the predetermined conditions are met, the contract automatically enforces the transaction. This removes the need for intermediaries like brokers, reducing costs and speeding up processes. For example, in DeFi lending, a smart contract can autonomously disburse a loan once collateral is deposited.

Decentralized Applications (dApps): The User Interface of DeFi

dApps are decentralized applications that run on blockchain networks. These provide the user interface for interacting with DeFi protocols. dApps allow users to lend, borrow, trade, and stake assets through their crypto wallets. They work like traditional financial apps but operate without any central authority. Examples include Uniswap for decentralized trading and Aave for lending and borrowing.

Blockchain Infrastructure: Ethereum and Beyond

The majority of DeFi applications are built on Ethereum, the second-largest blockchain, due to its robust smart contract functionality. However, other blockchains like Binance Smart Chain (BSC), Solana, and Polkadot are emerging as competitive alternatives due to their faster transaction speeds and lower fees. These blockchains aim to solve Ethereum’s current scalability issues while expanding the DeFi ecosystem.

4. Core Functions of DeFi: Recreating Traditional Financial Services

Decentralized Lending and Borrowing

In traditional finance, loans are issued through banks, which assess creditworthiness and dictate terms. DeFi lending platforms, like Aave and Compound, replace banks with smart contracts. Users can deposit crypto assets as collateral to borrow other assets. Since DeFi is decentralized, loans are typically over-collateralized, ensuring lenders are protected in case of borrower default. Borrowers can access funds without undergoing credit checks, while lenders earn interest directly from the protocol.

Decentralized Exchanges (DEXs): Trading Without Intermediaries

Decentralized exchanges (DEXs) like Uniswap and SushiSwap allow users to trade cryptocurrencies without relying on a central authority. Unlike traditional exchanges, where orders are matched through a centralized system, DEXs use automated market makers (AMMs), which enable liquidity pools to facilitate trades automatically. This peer-to-peer approach eliminates the need for an intermediary and reduces fees.

Stablecoins: Bridging Volatility with Stable Value

Cryptocurrencies are notorious for their volatility, which can make them less practical for everyday use. Stablecoins are a type of cryptocurrency pegged to a stable asset like the US dollar, offering the stability of fiat currency while maintaining the benefits of decentralization. Examples include USDT (Tether), USDC (USD Coin), and DAI—the latter being a decentralized stablecoin governed by the MakerDAO protocol.

Yield Farming and Staking: How Users Earn in DeFi

Yield farming involves lending or staking crypto assets in liquidity pools to earn rewards in the form of additional tokens. It is one of the most popular ways to earn passive income in DeFi. Staking, on the other hand, involves locking up assets in a blockchain network (typically a Proof of Stake chain) to secure the network and earn rewards. Both activities are high-reward but come with risks, including the potential for losses due to market volatility or protocol vulnerabilities.

Tokenization: Digital Assets in the DeFi Ecosystem

Tokenization is the process of converting real-world assets, such as real estate or company shares, into digital tokens that can be traded on the blockchain. Tokenization enables fractional ownership, allowing users to buy small portions of valuable assets, increasing liquidity and accessibility. DeFi protocols make it easy to issue and trade tokenized assets, broadening the scope of financial products available on the blockchain.

5. Popular DeFi Platforms and Protocols

Uniswap: The Leading Decentralized Exchange

Uniswap is one of the largest decentralized exchanges (DEXs) in the DeFi space. It allows users to trade ERC-20 tokens directly from their wallets without the need for intermediaries. With its innovative AMM system, Uniswap offers seamless and permissionless trading with high liquidity.

Aave and Compound: Innovators in Decentralized Lending

Aave and Compound are leading DeFi platforms in the decentralized lending space. These protocols allow users to earn interest on their crypto deposits and borrow assets using crypto as collateral. Aave introduced features like flash loans (instant, collateral-free loans) and variable interest rates, which have significantly broadened the use cases of DeFi lending.

MakerDAO: The Pioneer of Decentralized Stablecoins

MakerDAO is responsible for DAI, the first decentralized stablecoin. DAI is an algorithmic stablecoin pegged to the US dollar and backed by various crypto assets. MakerDAO’s system relies on smart contracts to maintain DAI’s peg through over-collateralization and automated liquidations.

Curve Finance, SushiSwap, and Yearn Finance: Expanding DeFi’s Reach

- Curve Finance is a decentralized exchange optimized for stablecoin trading, offering low fees and slippage for traders.

- SushiSwap started as a fork of Uniswap but has evolved into a comprehensive DeFi ecosystem offering more incentives for liquidity providers.

- Yearn Finance simplifies yield farming by automating the process of finding the best returns for users’ assets across multiple DeFi protocols.

6. The Benefits of DeFi: Why It’s Transforming Finance

Financial Inclusion: Banking the Unbanked

DeFi enables financial inclusion by offering services to anyone with internet access, especially in regions where traditional banking infrastructure is lacking. DeFi allows individuals to save, borrow, and invest without needing a bank account, breaking down financial barriers for millions globally.

No Middlemen: Lower Costs and Greater Efficiency

By eliminating intermediaries, DeFi significantly reduces transaction costs. Traditional financial systems are laden with fees from banks, brokers, and payment processors, but DeFi enables direct peer-to-peer interactions governed by code, which can be faster and cheaper.

Innovation and Flexibility: New Financial Products and Services

DeFi’s open and composable nature fosters rapid innovation. Developers can build on existing DeFi protocols to create new financial products and services. For example, decentralized insurance, prediction markets, and synthetic assets are all emerging sectors within DeFi.

Accessibility: 24/7, Global Access to Financial Tools

Traditional finance operates within fixed hours and regional limitations, but DeFi is accessible 24/7. Whether you’re in Tokyo, New York, or Lagos, you can trade, borrow, or lend at any time, making DeFi a truly global financial system.

7. The Risks and Challenges of DeFi

Smart Contract Vulnerabilities: Risks of Code Exploits

While smart contracts enable trustless transactions, they are not immune to bugs or vulnerabilities. If a smart contract is poorly coded, it can be exploited by malicious actors, resulting in the loss of user funds. Audits and security checks help reduce this risk, but they cannot eliminate it entirely.

Regulatory Uncertainty: Governments and DeFi

As DeFi grows, governments and regulators are taking notice. However, DeFi’s decentralized nature complicates regulation, as there is no central authority to hold accountable. The regulatory landscape is evolving, and how governments choose to regulate DeFi will impact its future development.

Market Volatility and Liquidity Risks

DeFi operates in the highly volatile crypto market. The value of assets used as collateral in DeFi can fluctuate rapidly, leading to liquidations (forced sales of collateral) during market crashes. This volatility poses a significant risk, particularly for borrowers.

User Responsibility: The Importance of Private Keys and Security

Unlike traditional banks, which safeguard your funds, DeFi requires users to take full responsibility for their private keys. Losing access to your private keys means losing access to your funds. Additionally, phishing attacks and scams are common, requiring users to stay vigilant about their security practices.

8. DeFi and Traditional Finance: Competition or Collaboration?

Will DeFi Replace Banks or Coexist with Them?

The rise of DeFi has led to speculation about whether it will replace traditional banks. While DeFi offers many advantages, it’s unlikely to completely replace traditional finance in the near term. Instead, the two systems are more likely to coexist, with DeFi providing alternatives for those seeking greater financial freedom, while traditional finance adapts by integrating blockchain and DeFi technologies.

Institutional Interest: Are Banks and Corporations Getting Into DeFi?

Institutions are starting to take note of DeFi’s potential. Major companies, including JPMorgan and Goldman Sachs, are exploring ways to incorporate DeFi into their business models. Meanwhile, institutional DeFi services, such as Aave Pro, cater to large investors with compliant, permissioned versions of DeFi protocols.

Bridging Traditional Finance and DeFi: Tokenization of Real-World Assets

Tokenization allows real-world assets like real estate, commodities, and stocks to be represented as digital tokens on the blockchain. This could potentially bridge the gap between traditional finance and DeFi, as it enables the liquidity and transparency of blockchain while still tethering assets to their real-world value.

9. The Future of DeFi: What’s Next?

Layer 2 Scaling Solutions: Solving Ethereum’s Scalability Issues

Ethereum’s growth in DeFi has been accompanied by high fees and network congestion. Layer 2 solutions like Optimism and Arbitrum aim to solve these scalability issues by processing transactions off-chain, then settling them on Ethereum, reducing costs and improving transaction speeds.

Cross-Chain DeFi: Interoperability Between Blockchains

One of the current limitations of DeFi is its fragmentation across different blockchains. However, cross-chain solutions like Polkadot and Cosmos are working to create interoperability between blockchains, allowing assets and data to flow seamlessly across multiple DeFi ecosystems.

Privacy in DeFi: Enhancing User Anonymity

While DeFi transactions are transparent, they are not entirely private. As demand for privacy grows, protocols like Tornado Cash and Aztec are exploring ways to offer more privacy in DeFi, enabling users to transact anonymously without compromising security.

The Role of Artificial Intelligence (AI) in DeFi

Artificial Intelligence (AI) has the potential to optimize DeFi in areas like risk assessment, liquidity management, and automated decision-making. AI-driven DeFi products could further streamline the efficiency of decentralized protocols, making DeFi more accessible to a broader audience.

10. Conclusion: Why DeFi Matters for the Future of Finance

Recap of DeFi’s Impact and Potential

DeFi has the potential to revolutionize finance by creating a more inclusive, transparent, and efficient system. By cutting out intermediaries, reducing costs, and increasing accessibility, DeFi is opening up financial opportunities to millions of people around the world.

What Does the Growth of DeFi Mean for Individuals and Institutions?

For individuals, DeFi offers unprecedented control over their financial assets. For institutions, it presents both a challenge and an opportunity to evolve. As DeFi continues to grow, its impact on the global financial system will become increasingly significant.

Final Thoughts: How to Get Started with DeFi Safely

If you’re new to DeFi, it’s important to approach with caution. Start by educating yourself on basic concepts, use trusted wallets, and only invest what you can afford to lose. As with any financial system, there are risks, but DeFi’s potential rewards are substantial for those who navigate it wisely.

[…] What is DeFi (Decentralized Finance) and How It Works […]